A meeting has been held between officials of the Finance Ministry and the Bank of Ghana (BoG) on one hand and the leaders of financial institutions in the country on how the government plans to revise the public debt which is at “a major crisis level”.

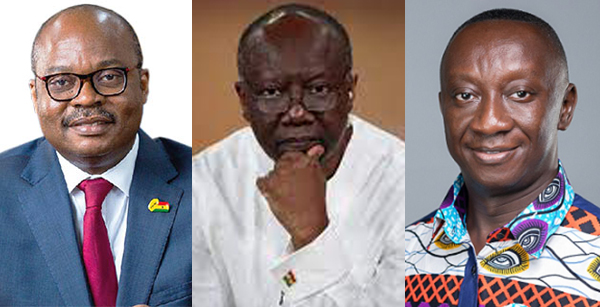

Present at the meeting, which was held on Saturday, December 3, 2022, in Accra were Finance Minister, Ken Ofori-Atta, the Governor of Bank of Ghana, Ernest Addison, the Director of Treasury and Debt Management Division at the Finance Ministry, Samuel Arkhurst among others.

They confessed on a secret meeting to the Financial Institutions that the country’s debt crisis will last till 2037 with lots of unintended consequences on every facet of national and individual lives.

They plan to roll out the draconian measures sometime this week.

At the individual level, pension, insurance and lifetime savings put into buying government bonds, will be severely affected.

Commercial Banks who have also bought government bonds, will also be affected, and may even cause a run on them as people panic.

At the meeting, the Director of Treasury and Debt Management Division at the Finance Ministry, Samuel Arkhurst, admitted Ghana’s Debt Sustainability Analysis (DSA) has shown that the country’s debt is unsustainable with Debt to GDP ratio currently at 105percent, if debts of State-Owned-Enterprises (SOEs) and all arrears owed are added to the public debt.

Interestingly, the Finance Minister, had claimed in the 2023 budget that it was 76percent.

Mr Arkhurst, revealed that due to the high levels of debt, the International Monetary Fund (IMF) is insisting that the debt to GDP ratio should be brought down to 55percent by 2028.

According to Mr Arkhurst, to achieve the 55percent, the government would have to do “debt treatment”, which is a euphemism for haircuts, despite the President Nana Akufo-Addo’s categorical claim that there will be no haircut.

The intended “debt treatment” would be carried out as follows; in 2023 they will not pay any interest on domestic bonds, in 2024, they will pay only 5percent interest no matter the interest agreed on at the time the bond was issued.

In 2025, the government will pay only 10percent.

When it comes to principal payments for domestic bond holders, the government intends to pay; 17percent of the principal in 2027, 17percent of the principal in 2029, 25percent of the principal in 2032, 41percent of the principal in 2037.

Per the agreement with bond holders at the time of borrowing, the principal was to be paid in full.

For external bond holders, they will take a 30percent haircut on the principal and 30percent haircut on interest.

The maturity period for all bonds, has been extended by 20 years, which means anytime from now, for all bonds that are due for payment it will not be paid until 20 years from the due date.

Analysts have said that this simply means after destroying the economy through reckless borrowing and corruption, the Akufo-Addo government is refusing to pay people who have put their lifetime savings into buying government bonds.

“After the banks who have bought government bonds, this will also affect insurance companies who have invested in government bonds and this will in turn affect pensioners who depend on pension payments for survival.

“It will affect contractors who are owed tens of billions of cedis by government who already have had the value of their money substantially whittled away due to depreciation of the cedis and inflation and the long delays in paying them

“And all this pain and suffering could have been avoided if Akufo-Addo/Bawumia and Ken Ofori Atta had managed the economy well.

—