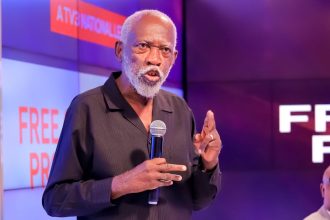

The Head of Compliance, Domestic Tax Revenue Unit at the Ghana Revenue Authority (GRA) has made some clarifications about the yet-to-be-implemented Electronic Transfer Levy (E-Levy).

According to Victor Yao Akogo, electronic transfers between accounts owned by the same person will not be subjected to the 1.5 per cent tax of the newly introduced levy.

He, however, said there is a condition to this exemption.

Speaking on JoyNews’ The Probe on Sunday, Mr Akogo said citizens must ensure all their accounts have been linked to the National Identification Card (GhanaCard).

“We have a unique identifier which is the GhanaCard and that is what we are going to use. There are some people who have used their passport to register their account, we are saying that for you to qualify for the exemption.

“So there is the need to let your GhanaCard be linked to all your accounts so that it will be the unique identifier of you everywhere so that you can enjoy the exemption,” he stated.

Following the passage of the Electronic Transfer Law, the GRA has indicated its readiness to implement it from May 1.