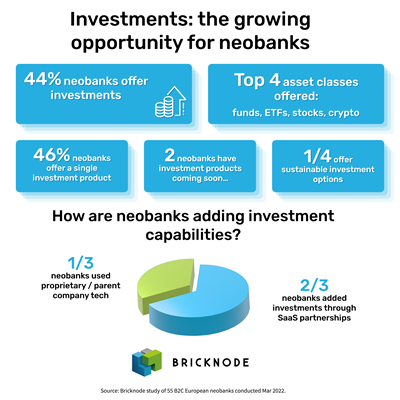

The percentage of European neobanks currently offering investment products is 44% according to a research article Investments: the growing opportunity for neobanks published today by Bricknode, a leading SaaS financial services platform. The research also finds:

- 54% of neobanks with investment products offer multiple asset classes

- The most common asset classes offered by neobanks are: funds, exchange-traded funds (ETFs), stocks and cryptocurrency

- One quarter offer sustainable investment options

- Two thirds implemented investment products through SaaS partnerships

The article highlights trends among neobanks offering investment products, and the role these firms play in the democratization of investing.

Of those neobanks offering investments, 54% provided multiple asset classes, while the remaining 46% currently offered a single type of investment. The most common asset class offered is mutual funds, closely followed by ETFs, stocks and cryptocurrency. One quarter had sustainable offerings, which included packaged investments in a range of environmentally and socially responsible companies.

The research also revealed that two thirds of neobanks had leveraged SaaS partnerships in order to launch their investment offering, while one third had utilised proprietary or parent company technology.

“The growing popularity of investing is being driven by financial technology, with new mobile trading applications and user-friendly products,” says Erik Hagelin, Co-CEO of Bricknode. “Our research shows that neobanks are quickly cashing in on this trend by partnering with companies that offer pre-built SaaS investment tech and infrastructure.”

More neobanks are in the process of implementing investment products, with reports that UK-based Monzo is recruiting for a new investment and wealth unit, while Germany’s Tomorrow will soon be launching a sustainable investment solution. Tomorrow will join Dutch neobank Bunq who recently launched its own sustainable-focused product.

This research was carried out by Bricknode in March 2022 by analysing 81 neobanks with headquarters in Europe, based on a NeoBanks.app list plus five additional companies known to Bricknode. Pre-launch, B2B and kids/teenager neobank companies were excluded from the final analysis, leaving a sample size of 55.

All investment product data, including asset classes was sourced from the neobanks’ own websites or apps. Data pertaining to investment/SaaS partnerships was sourced from neobanks’ websites and press releases.